In March 2021, the World Conservation Monitoring Centre (WCMC) Europe, the Capitals Coalition, Arcadis, the International Coaching Federation (ICF), and UNEP-WCMC launched the Align project – Aligning accounting approaches for nature. Funded by the European Commission, the Align project will support businesses, financial institutions, and other stakeholders in developing standardised natural capital accounting practices, including a standardised approach to biodiversity measurement and valuation.

Standardised natural capital accounting practices

CAPITALS COALITION published the world’s first standardised natural capital accounting practices methodology in July 2023. It provides practical application guidance for corporate accountants who are in charge of establishing a natural capital accounting system.

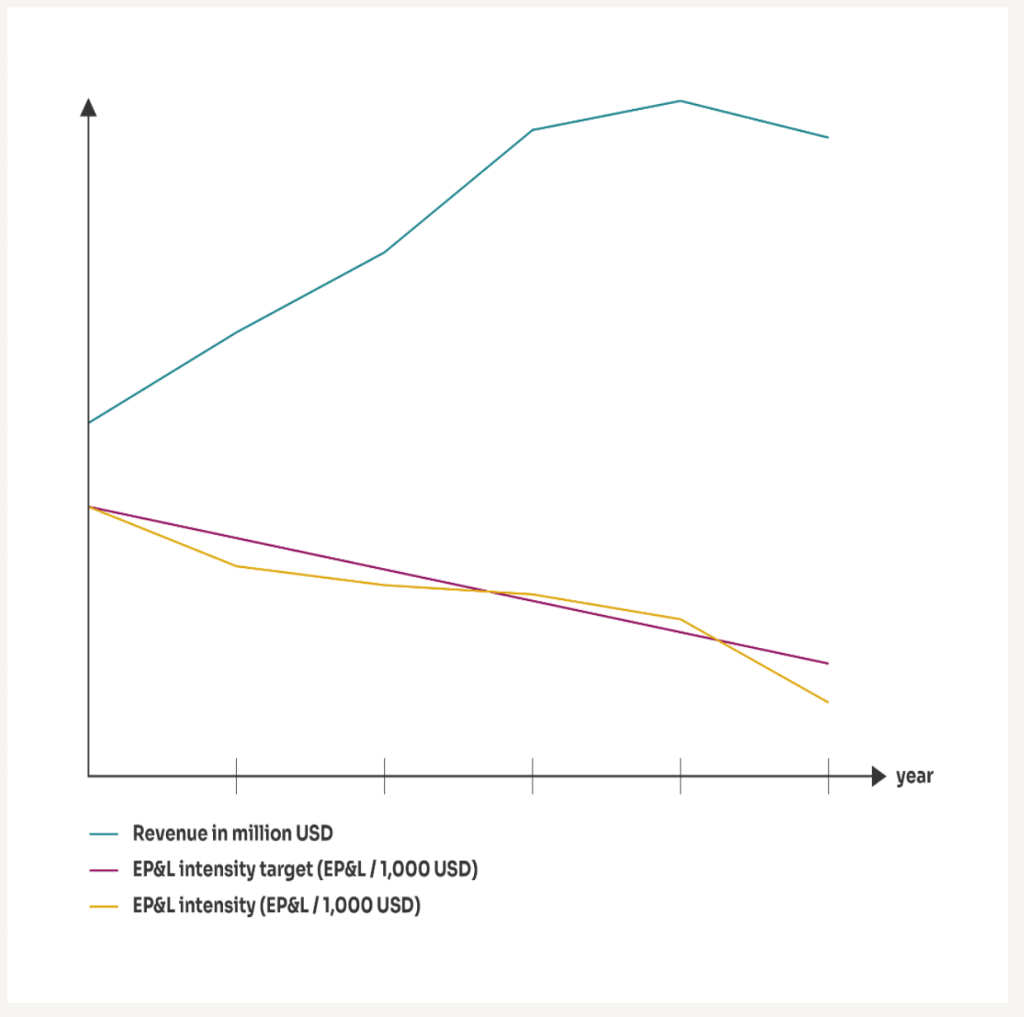

This process is called an ‘environmental profit and loss’ (EP&L) for designating the change in natural capital resulting from a business’ activities. Intensity is tracked over time against a predefined target (Figure 1).

The outputs can be presented in a table of value chain boundaries and impact drivers (Table 1). Each impact factor – greenhouse (GHG) gas, non-greenhouse gas, water consumption, water pollution, land use, and solid waste – has specific accounting modules.

For instance, when it comes to greenhouse gases, the methodology document says that measuring the impact driver requires measuring the mass of GHG emissions to air. The quantitative indicators for the main GHG pollutants that should be measured are: tons of carbon dioxide CO2, of methane (CH4), of nitrous oxide (N2O), of perfluorocarbons (PFCs), of hydrofluorocarbons (HFCs), of sulfur hexafluoride (SF6), of nitrogen trifluoride (NF3), and other (non-Kyoto) GHGs. All are obligatory except for non-Kyoto GHGs which are optional.

In parallel, the decline in biodiversity is unprecedented, partly because nature was not part of current economic thinking. Different approaches have been developed to measure corporate biodiversity performance. For instance, managing natural capital rarely considers biodiversity, which opens the door to losing opportunities and not managing risks.

Different approaches

The different approaches for measuring corporate biodiversity performance can be the following:

Biodiversity Footprinting involves assessing a company’s activities’ direct and indirect impacts on biodiversity. This approach aims to quantify these impacts and comprehensively understand a company’s biodiversity performance.

Biodiversity Indicators are specific metrics used to assess changes in biodiversity over time. These indicators can be applied at different levels, including species, habitats, ecosystems, and landscapes. Companies can use biodiversity indicators to monitor and evaluate their performance in relation to biodiversity conservation goals.

Habitat and Ecosystem Assessments evaluate the condition and health of habitats and ecosystems affected by a company’s operations. Companies may conduct these assessments to identify areas of high biodiversity value, assess potential impacts, and develop strategies for conservation and restoration.

Supply Chain Analysis involves mapping out the various stages of a company’s supply chain and assessing the biodiversity risks and opportunities associated with each stage. Many companies rely on complex supply chains that may significantly impact biodiversity, particularly in the agriculture, forestry, and mining sectors.

This approach helps companies identify hotspots where biodiversity impacts are most significant and develop strategies to address them.

Natural Capital Accounting involves valuing the benefits provided by ecosystems and biodiversity in monetary terms. Companies can use natural capital accounting frameworks to assess the value of ecosystem services, such as pollination, water purification, and carbon sequestration, and incorporate these values into their decision-making processes.

Biodiversity Offsetting involves compensating for biodiversity impacts associated with a company’s activities by investing in conservation or restoration projects elsewhere. Companies may use biodiversity offsetting as a strategy to achieve no net loss or a net gain of biodiversity in the long term.

According to the recommendations of the Align project, published at the end of 2022, a biodiversity footprint can model the pressures exerted by an organisation on ecosystems or species within a given area.

Towards a deeper understanding of biodiversity footprinting (link to the next blog on Biodiversity footpring).

Leave a comment